Investment in net working capital arises when businesses seek to optimize their short-term liquidity and financial performance. Understanding the reasons, factors, and methods involved in this investment is crucial for businesses to effectively manage their working capital and drive growth.

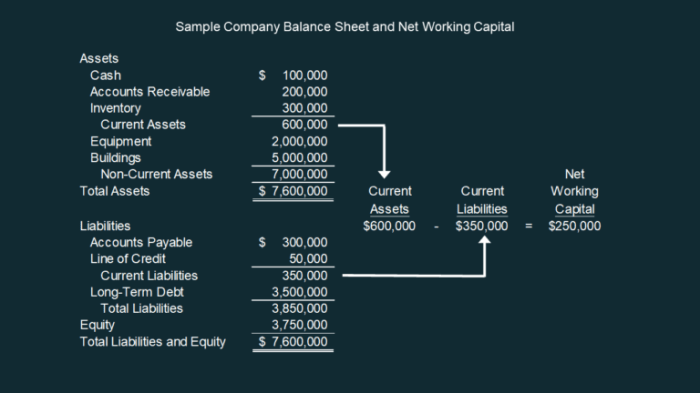

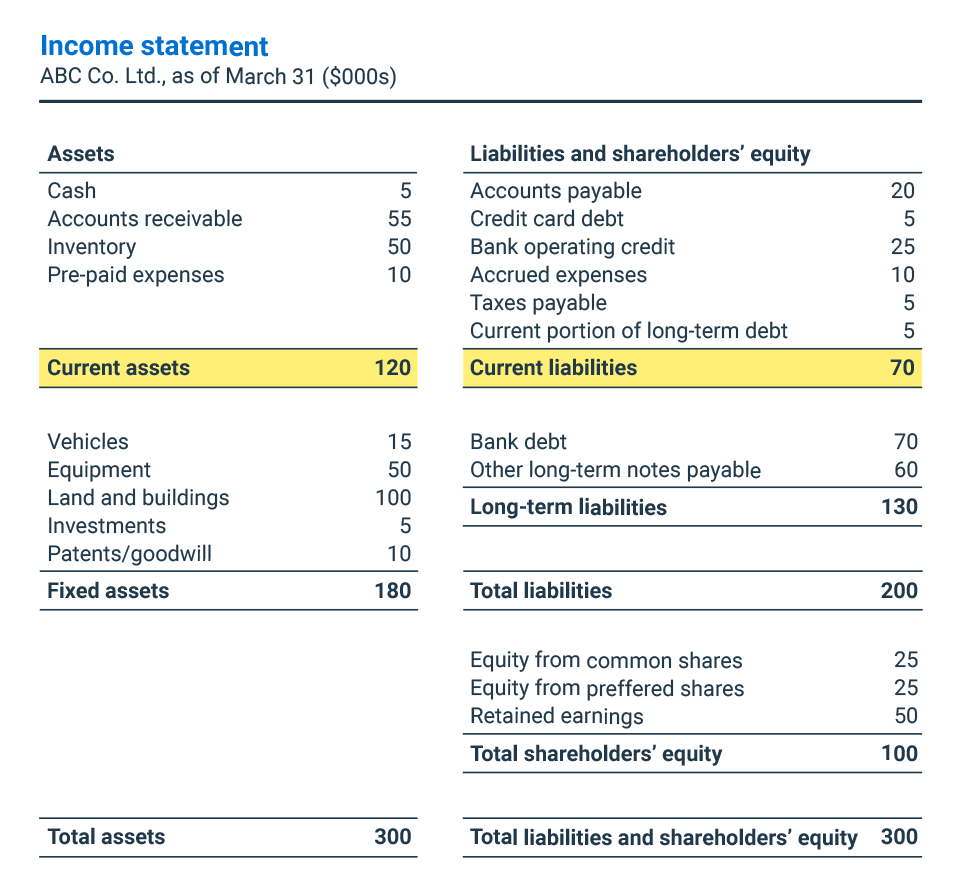

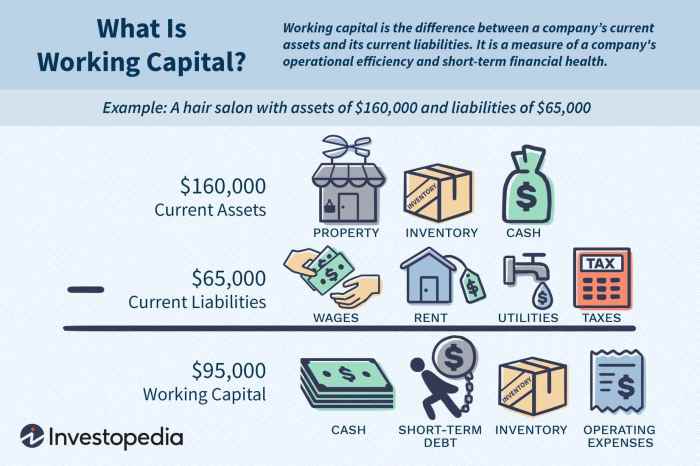

Net working capital represents the difference between a company’s current assets and current liabilities, indicating its ability to meet short-term obligations and fund day-to-day operations. Investing in net working capital aims to ensure sufficient liquidity to cover expenses, maintain inventory, and support business growth.

Investment in Net Working Capital: Investment In Net Working Capital Arises When

Investment in net working capital (NWC) refers to the funds invested in current assets that are required for the day-to-day operations of a business. It is the difference between a company’s current assets and current liabilities.

The purpose of investing in NWC is to ensure that a business has sufficient liquidity to meet its short-term obligations, such as paying suppliers, employees, and taxes. It also allows a company to take advantage of growth opportunities, such as expanding into new markets or launching new products.

Reasons for Investment in Net Working Capital

Investment in NWC arises when a business experiences a growth in sales or operations. This growth can lead to an increase in current assets, such as inventory, accounts receivable, and cash. It can also lead to an increase in current liabilities, such as accounts payable and accrued expenses.

- Seasonal fluctuations:Businesses that experience seasonal fluctuations in sales may need to invest in NWC to meet the increased demand during peak periods.

- Expansion into new markets:Expanding into new markets can require a significant investment in NWC to cover the costs of marketing, sales, and inventory.

- Product launches:Launching new products can also require a significant investment in NWC to cover the costs of development, marketing, and inventory.

Factors to Consider When Investing

Before investing in NWC, a business should consider the following factors:

- Cost of capital:The cost of capital is the rate of return that a business must pay to borrow money. A business should consider the cost of capital when deciding how much to invest in NWC.

- Return on investment:The return on investment (ROI) is the rate of return that a business expects to earn on its investment in NWC. A business should consider the ROI when deciding how much to invest in NWC.

- Risk tolerance:The risk tolerance of a business is its willingness to take on risk. A business should consider its risk tolerance when deciding how much to invest in NWC.

Methods for Investing in Net Working Capital

There are a number of different methods for investing in NWC. The most common methods include:

- Short-term borrowing:Short-term borrowing is a type of financing that is used to meet short-term needs. Short-term borrowing can be used to invest in NWC.

- Long-term borrowing:Long-term borrowing is a type of financing that is used to meet long-term needs. Long-term borrowing can be used to invest in NWC.

- Equity financing:Equity financing is a type of financing that is raised by selling shares of stock. Equity financing can be used to invest in NWC.

Benefits of Investing in Net Working Capital

There are a number of benefits to investing in NWC. These benefits include:

- Increased liquidity:Investing in NWC can increase a business’s liquidity. This can help a business to meet its short-term obligations and take advantage of growth opportunities.

- Improved financial performance:Investing in NWC can improve a business’s financial performance. This is because it can help a business to reduce its costs and increase its profits.

- Reduced risk:Investing in NWC can reduce a business’s risk. This is because it can help a business to avoid financial distress and bankruptcy.

Risks of Investing in Net Working Capital

There are also a number of risks associated with investing in NWC. These risks include:

- Increased costs:Investing in NWC can increase a business’s costs. This is because it can lead to higher interest payments and other financing costs.

- Reduced profitability:Investing in NWC can reduce a business’s profitability. This is because it can lead to higher inventory costs and other operating expenses.

- Increased risk:Investing in NWC can increase a business’s risk. This is because it can lead to financial distress and bankruptcy if a business is unable to meet its short-term obligations.

Managing Investment in Net Working Capital, Investment in net working capital arises when

It is important for businesses to manage their investment in NWC carefully. This can be done by:

- Monitoring NWC levels:Businesses should monitor their NWC levels on a regular basis. This will help them to identify any potential problems.

- Adjusting NWC levels:Businesses should adjust their NWC levels as needed. This can be done by increasing or decreasing their investment in current assets and current liabilities.

- Developing a NWC policy:Businesses should develop a NWC policy. This policy should Artikel the company’s goals for NWC and the strategies that will be used to achieve those goals.

General Inquiries

What are the key factors to consider when investing in net working capital?

Factors to consider include the business’s operating cycle, industry norms, growth plans, and financial risk tolerance.

What are the different methods for investing in net working capital?

Methods include increasing inventory, extending credit to customers, and reducing accounts payable.

What are the potential risks associated with investing in net working capital?

Risks include excess inventory, bad debt, and liquidity constraints.